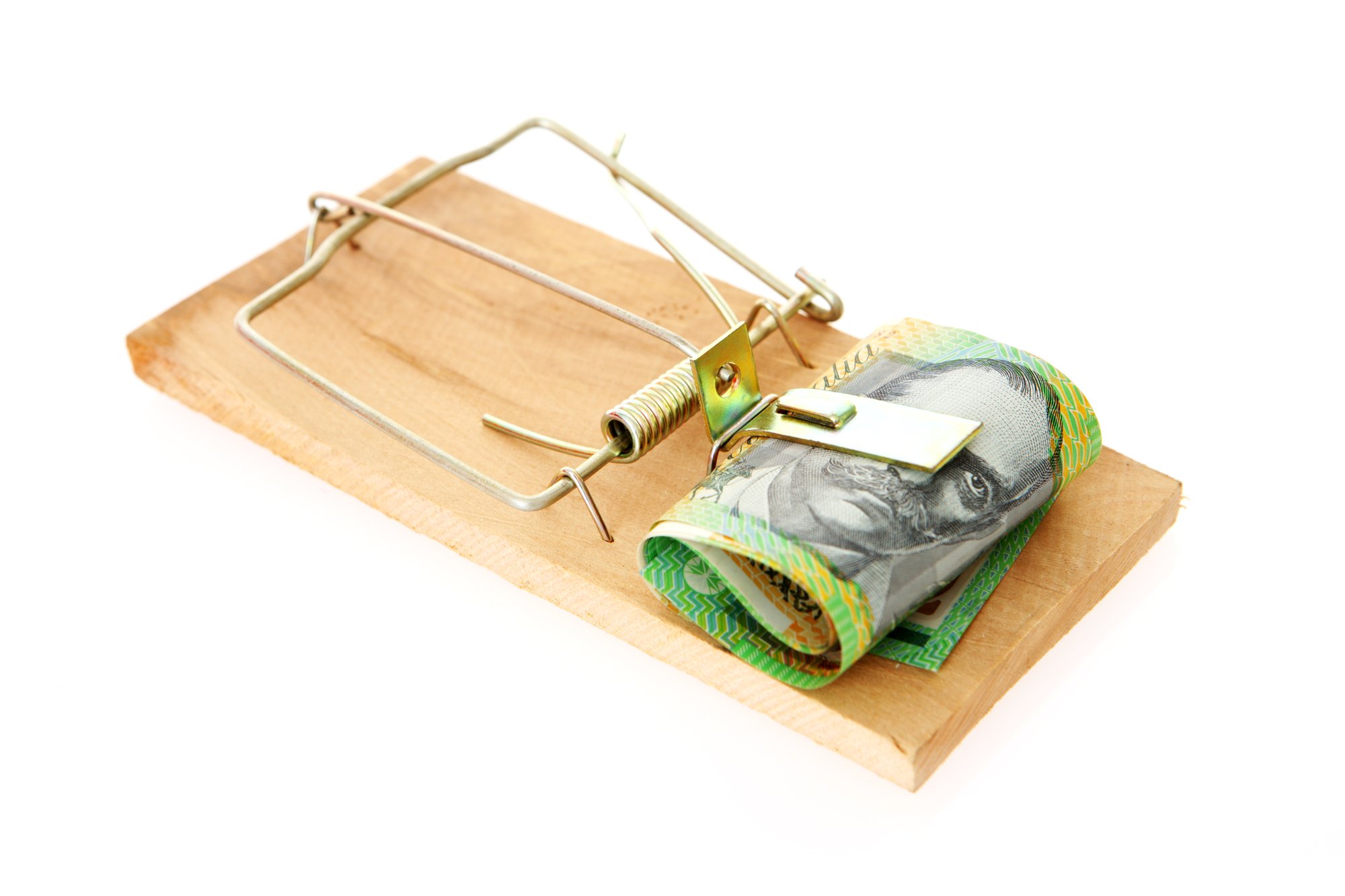

Pitfall Of Transferring Surplus Business Cash To A Personal Offset Account

It has been a common practice of business owners, operating through companies, to transfer surplus cash into personal mortgage offset accounts. Then at the end of a financial year transferring the cash back into the business to avoid the consequences of Division 7A (i.e. the funds being treated as an unfranked dividend in the hands of the recipient), before transferring it all back to the offset account in July.

As a business owner it can be really tempting to get the benefit of the 25% company tax rate on cash but have the benefit of that cash reducing the interest being paid on your mortgage, or so they think. ***SPOILER ALERT *** There is a specific section of the Tax Act that operates to discourage business owners from doing just that. Section 109R outlines the situation where a reduction in a loan balance (such as the movement of cash back into the business prior to 30 June) is not considered a loan repayment.

To paraphrase from the Tax Act there are 2 circumstances where a payment of a loan, where a shareholder or associate owes money to the company will not be taken as a repayment, and they are:

a reasonable person would conclude that, when the payment was made, that the shareholder/associate intended to obtain a loan from the company of a total amount similar to, or larger than, the payment.

This would happen if a payment was made to the loan before 30 June and then a similar or larger amount was transferred after.

OR

both of the following:

a) the shareholder/associated obtained, before the payment was made, a loan from the private company of a total amount similar to, or larger than, the amount of the payment;

b) a reasonable person would conclude that the shareholder/associate obtained the loan in order to make the payment.

This would happen if there was an existing loan and further funds were transferred from the company prior to 30 June in order to repay the first loan, leaving a newer loan that otherwise would fall outside of the Division 7A rules.

The result of being found in either of these circumstances is that the amount of the payments disallowed as a loan repayment will be treated as an unfranked dividend in the hands of the recipient, which can result in some large and unintended tax consequences.

Paying tax to take profit out of the company may not seem appealing, however there are compelling reasons to do so. Our blog The problem with leaving profits in your company explains further.

If you would like specific advice tailored to your business and circumstances, Accounting Heart offers affordable service packages where you can work with Sonia one-on-one to help you get your business where you want it to be. Book your FREE Discovery Call to find out more.

Disclaimer: This is general information only and is not advice of any sort. No warranty or representation is provided by Accounting Heart Pty Ltd as to the accuracy, currency or completeness of the information contained in this blog. Readers of this blog should not act or refrain from acting in reliance upon any information contained herein and must always obtain appropriate taxation and / or other advice as may be appropriate having regard to their particular circumstances.